Consumer data privacy is no longer optional — it’s an expectation. As public awareness grows, so does the pressure on businesses to handle personal information responsibly. The California Consumer Privacy Act (CCPA) has significantly reshaped how companies manage data, particularly for enterprise firms that handle large volumes of customer information.

In an age where data sharing is inevitable, compliance isn't just about avoiding fines; it’s about keeping your clients ' trust.

Given its enormous potential value, marketers view consumer data as the new gold in the digital era. Still, a growing movement demands that the consumers being examined by such data have a say in how the information they have provided is used or not used, even though corporate interests want to mine this data.

It's through this that California has become well-known for fighting for the protection of consumers, citizens, and residents' rights. The state’s approach has set the tone for how other local governments shape their privacy laws.

The CPPA has made it quite apparent that privacy compliance involves more than just making the appropriate disclosures; it also consists of determining whether your systems are functioning properly. It gives California residents a path to a personal right of action in order to seek legal justice for data breaches.

Many organisations are still blurring the lines, so understanding what the CCPA Act is all about might help.

What is the California Consumer Privacy Act (CCPA)?

According to the California district, the California Consumer Privacy Act of 2018 (CCPA) grants consumers greater control over the personal information that businesses collect about them, and the CCPA regulations offer guidance on how to implement the law.

California voters approved Proposition 24, the CPRA, in November 2020, which amended the CCPA and added additional privacy protections which started on January 1, 2023. As of January 1, 2023, consumers have new rights in addition to those above, such as:

Businesses that are subject to the CCPA have several responsibilities, including responding to consumer requests to exercise these rights and giving consumers certain notices explaining their privacy practices. The CCPA applies to many businesses, including data brokers.

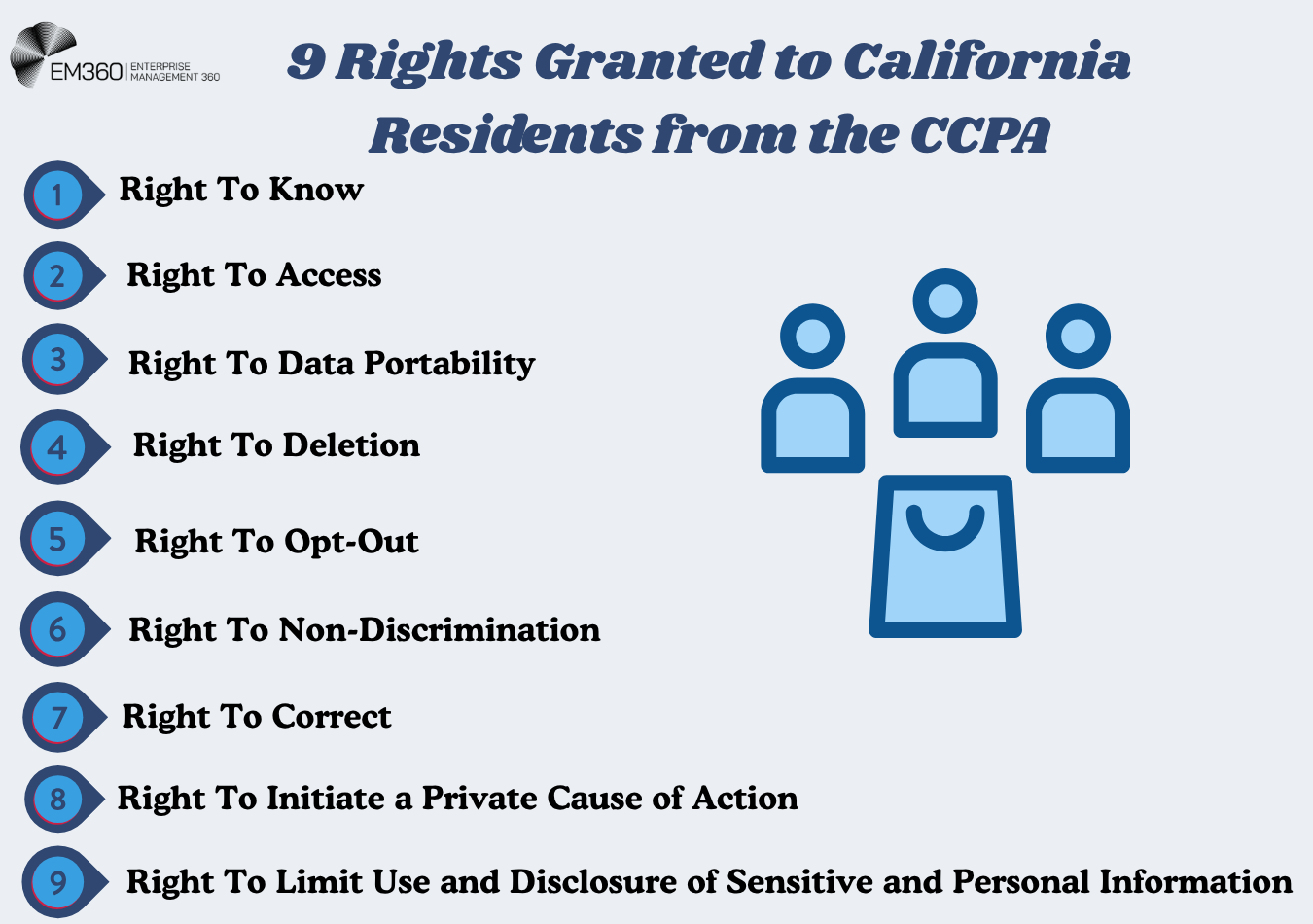

Privacy Rights Under the CCPA

The CCPA, strengthened by the California Privacy Rights Act (CPRA), gives California residents a clear set of rights over their personal data.

Here’s what those rights mean in practice:

1. The right to know

Consumers have the right to know what personal data is being collected about them.

2. The right to access

Consumers can request access to their personal data held by businesses.

3. The right to data portability

Consumers can request that their data be provided in a portable and readily usable format.

4. The right to deletion

Consumers can request the deletion of their personal data.

5. The right to opt out

Consumers can opt out of the sale of their personal data.

6. The right to non-discrimination

Consumers have the right not to be discriminated against for exercising their CCPA rights.

7. The right to correct

Consumers can request corrections to inaccurate personal data.

8. The right to limit the use and disclosure of sensitive personal information

Consumers can restrict businesses from using or disclosing their sensitive personal information beyond what is necessary for providing services or products.

9. The right to initiate a private cause of action

Consumers can sue businesses in the event of certain data breaches involving non-encrypted and non-redacted personal information

CCPA Protection

The question is, what protection does this act give consumers? It's important to remember that the CCPA standards were created to provide California consumers with a set of rights that specifically address personal data privacy while also providing acceptable security precautions. These rights include the opportunity for Californians to make consumer enquiries regarding their customer data.

These requests may include how to:

- Prevent the sale of their personal information to third-party companies (that is, the Right to Prevent Resale) by issuing the so-called “Do not sell my personal information” directive

- Ask for data about any personal information that has been collected (The Right to Access)

- Request that all collected data about that consumer be deleted (The Right to Be Forgotten)

The California Privacy Protection Agency ensures that California residents have adequate protections and are appropriately alerted about data changes impacting them. It also implements anti-discrimination laws, which provide that people cannot be subjugated or penalised for exercising their rights.

What Businesses Does the CCPA Apply to?

The CCPA sets clear guidelines that businesses must comply with its privacy regulations. In general, the law applies to for-profit organisations that do business in California and meet at least one of the following criteria:

- Generate more than $25 million in gross income annually

- Purchase, sell, or distribute the personal data of 100,000 or more Californians or households

- Sell the personal information of Californians for at least 50 per cent of their yearly income

Steps to Achieve CCPA Compliance

Nowadays, data privacy is more than just a box to be checked on a legal form; it is a fundamental component of customer and corporate trust. The California Consumer Privacy Act (CCPA) and its amendment, the California Privacy Rights Act (CPRA), have raised the bar for how businesses handle personal data.

Enterprise businesses may find CCPA compliance to be too much to handle when navigating intricate data ecosystems. However, the procedure becomes much more realistic when divided into reasonable parts, and it will eventually be beneficial for your brand's reputation and customer interactions.

Here’s how to approach CCPA compliance, not as a one-time task, but as a strategic, ongoing process.

Start with a shift in mindset

Before getting into the mechanics, recognise that CCPA compliance starts with putting the consumer at the centre of this whole process. Privacy isn’t just about avoiding penalties; it’s about respecting user rights and building transparency into your business model. That shift is important, especially for large enterprises managing high volumes of sensitive data.

Rather than following a rigid sequence, many of these steps can and should happen in parallel.

Here are the factors to consider when wanting to achieve CCPA compliance:

Step 1 - Conduct a comprehensive data inventory

As an organisation, you can’t protect what you don’t understand.

Start by mapping out:

- What personal data does your company collect?

- Where is the data stored?

- What is it used for

- Who has access to it?

This includes data from both customers and employees. You’ll want to account for everything from consumer transactions to job applications and catalogue their locations across systems, platforms, and vendors.

Step 2- Secure the data you collect

Once your data inventory is complete, ensure all information is properly protected. This includes:

- Encrypting stored data

- Implementing access controls

- Applying additional safeguards for sensitive categories (e.g., minors’ data or biometrics)

Step 3 - Notify consumers when collecting their data

Transparency is key. Under the CCPA, businesses must issue a clear “Notice at Collection” to inform users what data is being collected and why, ideally before or at the point of collection. This applies to all consumers, including employees and job applicants.

Step 4 - Publish and maintain a privacy policy

Your company’s privacy policy must be:

- Easy to find

- Easy to read

- Regularly updated

It should explain what data is collected, how it's used, and what rights consumers have under the CCPA, including how to exercise those rights.

Step 5 - Establish a process for handling consumer requests

Consumers have the right to access, delete, correct, or opt out of the sale of their personal data. You’ll need to set up at least two clear channels for these requests—typically:

- A toll-free phone number

- An online form or a dedicated email address

Requests must be acknowledged within 45 days, with possible extensions granted under specific conditions. Also, businesses are required to maintain records of these requests and responses for 24 months.

Step 6 - Enable a clear opt-out mechanism

If your business sells personal data, you must include a visible “Do Not Sell My Personal Information” link on your homepage. This empowers users to opt out and ensures compliance with consumer opt-out rights.

Step 7 - Train Your Staff

- Compliance isn't just an IT issue; it's an organisation-wide responsibility. Provide regular training to:

- Customer-facing staff

- Legal and compliance teams

- Data and security teams

Your employees should be equipped to recognise privacy-related requests and respond according to CCPA guidelines.

Step 8 - Review and update vendor contracts

Third-party vendors can create compliance risks if not properly managed. Review your contracts to ensure they include:

- Prohibitions on data resale

- Data handling requirements

- Shared responsibility for compliance

Step 9 - Implement and update security practices

While the CCPA doesn’t spell out exact security measures, businesses are expected to implement reasonable security procedures.

- These best practices include:

- Data encryption

- Access management

- Incident response planning

- Regular security audits

Step 10 - Stay current with CCPA changes

The law isn’t static. The CPRA has already introduced significant updates which directly affect the CPPA Act, and future amendments are likely. Make sure someone in your organisation owns the responsibility of tracking legislative changes and updating your policies and practices accordingly.

For instance, as part of its duties, CPPA released its first enforcement guidance in April 2024, establishing data minimisation as a CCPA tenet. It suggested revisions to the current CCPA/CPRA regulations have been proposed by the CPPA.

The revisions to the definition of sensitive personal information, the requirements for denying consumer requests, the verification of consumer requests, and the responsibilities of service providers and contractors, the updates also include new rules for risk assessments and Automated Decision-Making Technology (ADMT).

CCPA Penalties for Noncompliance

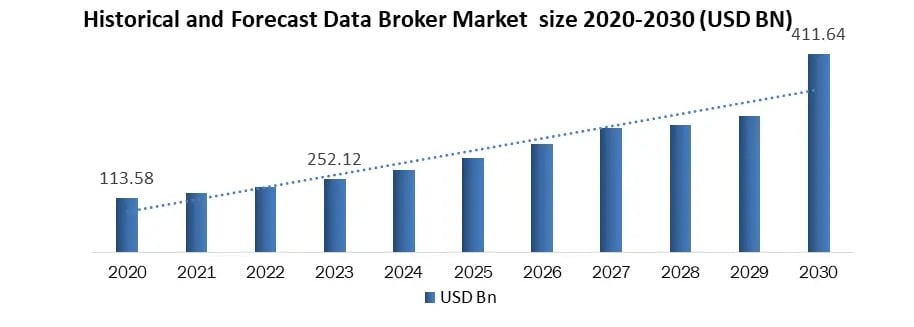

The commercial trade of personal information is a significant part of today’s digital economy. In 2024, the global data brokerage industry was valued at approximately USD at USD 270.40 Bn and is projected to exceed USD 450 billion by the end of the decade.

Given the value and sensitivity of personal data, the California Privacy Protection Agency (CPPA) has the authority to enforce the California Consumer Privacy Act (CCPA) through financial penalties.

Under the law, organisations can face fines of up to USD 2,500 per violation for unintentional noncompliance, and up to USD 7,500 for intentional violations. These amounts apply on a per-incident basis, meaning that each affected individual can count as a separate violation.

While these figures may seem modest in isolation, the impact scales quickly in the context of large-scale data incidents. Breaches or violations involving thousands of consumers could result in substantial cumulative penalties.

To encourage compliance, the CCPA includes a 30-day cure period. If a business addresses the issue within this window, by implementing corrective measures and improving data practices, it may avoid financial penalties.

However, remediation isn't always straightforward. In cases like data breaches, once personal information has been exposed, it may be impossible to fully undo the damage.

Examples of companies fined for CCPA violations

1. Facebook

In a historic case for data privacy enforcement, Facebook received the largest fine ever imposed on a company for mishandling user data. The U.S. Federal Trade Commission (FTC) levied a $5 billion penalty against the social media giant in 2019, marking one of the harshest penalties ever handed down by the U.S. government for any corporate infraction, not just privacy-related violations.

The fine was nearly 20 times larger than any previous global penalty for data protection failures, highlighting the growing regulatory focus on personal data misuse at scale. The case stemmed from Facebook’s violation of a 2012 FTC order, which required the company to give users clear and truthful information about how their personal data was shared. According to the FTC, Facebook misled users about their ability to control privacy settings, undermining user trust.

As part of the settlement, Facebook not only agreed to pay the historic fine but also accepted a series of new compliance measures. These included implementing a restructured corporate governance model, designed to increase board-level accountability and oversight of privacy-related decisions.

In a separate class-action lawsuit related to data misuse, Facebook later settled for $725 million, reinforcing the financial and reputational risks companies face when failing to meet consumer privacy expectations.

2. Epic Games

In one of the largest privacy-related enforcement actions to date, the U.S. Federal Trade Commission (FTC) issued a $520 million penalty against Epic Games, the company behind the popular online game Fortnite. The case involved two separate settlements addressing both violations of children’s privacy rights and deceptive design practices.

Of the total, $275 million was levied for violations of the Children’s Online Privacy Protection Act (COPPA), marking the largest penalty ever issued under the law. The FTC found that Epic had collected personal data from children under 13 without proper parental consent.

An additional $245 million was imposed as consumer redress, aimed at reimbursing users who were affected by allegedly manipulative interface designs that led to unintended in-game purchases.

“As our complaints note, Epic used privacy-invasive default settings and deceptive interfaces that tricked Fortnite users, including teenagers and children,” said FTC Chair Lina M. Khan in a statement.

The case highlights increasing regulatory scrutiny of digital platforms, especially those targeting younger audiences and sets a strong precedent for enforcement around design ethics and data handling in the gaming industry.

There is are list of companies that have violated privacy laws, and this could guide you to improve your organisation's practices.

The importance of CCPA compliance for businesses

A key takeaway from recent enforcement actions is that accountability cannot be outsourced. Businesses that collect or process personal data of California residents must take full ownership of their privacy practices.

If your organisation falls within the scope of the CCPA, understanding and implementing its requirements is essential. Beyond meeting legal obligations, compliance signals a broader commitment to data protection and transparency, qualities that increasingly shape customer trust and brand reputation.

Companies must be prepared to honour consumer rights under the CCPA, including requests to access, delete, or opt out of the sale or sharing of personal information. Updating privacy programs will also require attention to CCPA-specific elements such as prescriptive opt-out mechanisms and timely responses to individual data requests.

Ultimately, CCPA compliance should not be viewed solely as a regulatory hurdle but as an opportunity to strengthen your data governance strategy and align with evolving consumer expectations.

Comments ( 0 )